Bank Failures are common is about how the current media frenzy over a couple of recent bank failures is NOT cause for undo alarm. This is normal, every year.

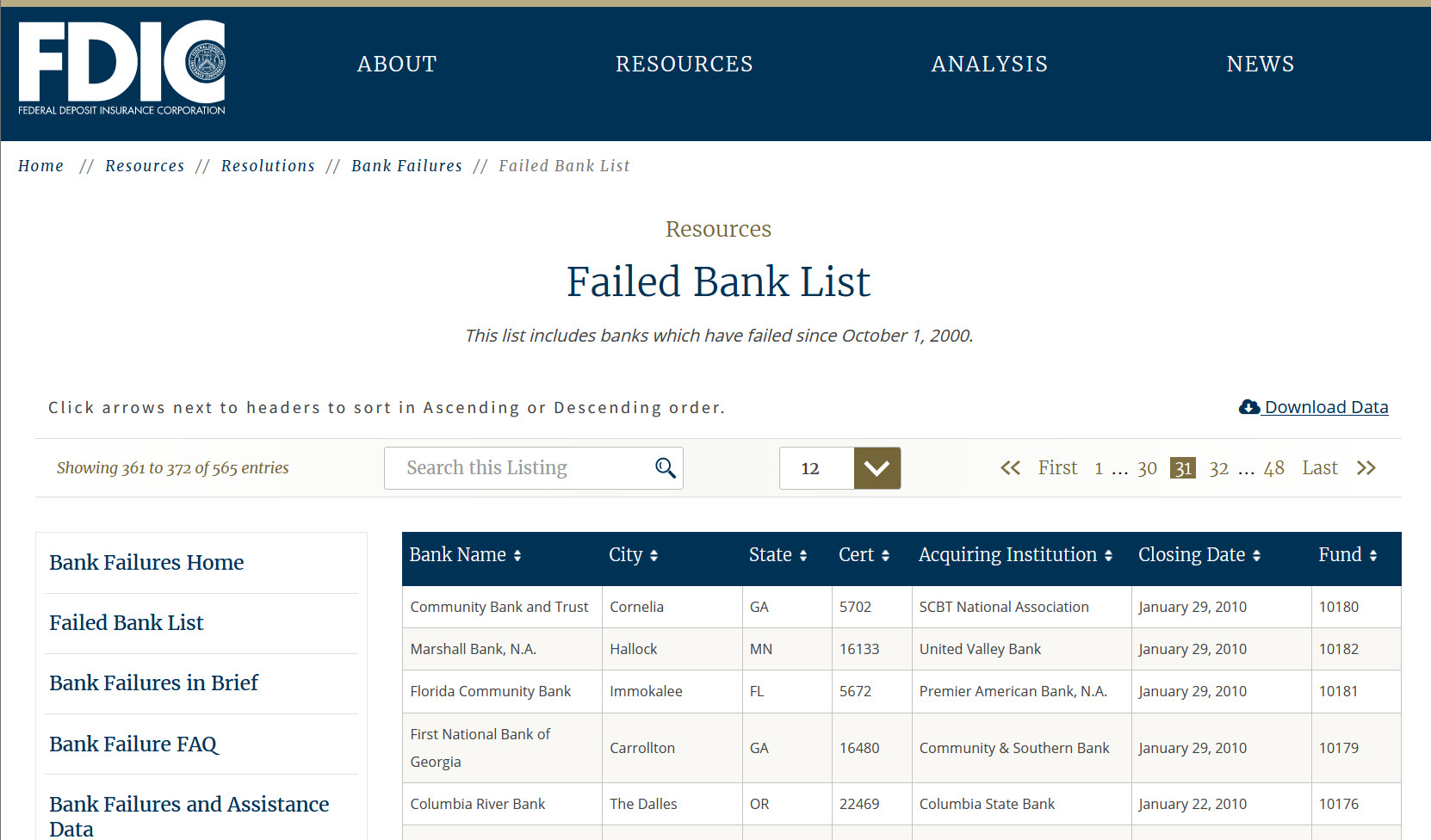

If you logon to the FDIC website here:

https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/

you will see that so far in this century, there have been dozens of bank failures. It is normal. And since the end of the Great Recession (circa 2010), there have been many more. Typically 4 to 10 nearly every year.

And yes, since November 2020, the SVB in California is the first bank failure since then. That absence of bank failures during the last recent few months was uncommon. So now that there are 2 or 3 bank failures so far in 2023 is normal for the banking industry. The FDIC is on a hair-trigger, poised to protect the assets of account owners, and that’s a good thing.

So: expect perhaps up to 12 or so bank failures for the remainder of 2023, and a few more in 2024 and 2025 and into the future. This is normal. The sky is not falling. The media should be ashamed. And they should do a better job of balanced reporting, and providing context for what’s happening in the USA and the world at large.

Just review the FDIC list of bank failures to prove it to yourself. Nothing out of the ordinary.