When Financing New Homes, there are critical valuations:

relating to the Appraisal and Your Lending Institution’s Loan Amount

…and your actual Construction Cost. Home Architects help their clients understand the balancing act between these amounts, to hopefully result in several things: A. that you obtain the loan you are seeking; B. that your loan is adequate to cover your construction cost.

This is not fiction or guesswork. This approach has worked successfully for the author for his family’s own refinancing. How well it will work for you depends on your circumstances and lending institution.

Obtain the services of a professional financial advisor before proceeding, to assist you in making prudent decisions. First of all, when financing new homes, let’s get an understanding of terms, including some of which are not in the headings above and how they interact :

(C)Copyright 2005-9 Home Architect, PLLC, All Rights Reserved Worldwide.

(C)Copyright 2005-9 Home Architect, PLLC, All Rights Reserved Worldwide.1. CMA

(Comparative Market Analysis): a realtor normally accomplishes this (as do Appraisers). It involves research, usually online through your realtor’s local MLS (Multiple Listing Service). Houses in your size, type and features and hoped-for value are downloaded, printed out and listed, then averaged, with a high and a low and a realtor’s best guess as to how much your house might be worth, compared to the actual sales of these nearby examples. Nearby typically means within a few miles (5+/-), but this area can expand when similar comparables cannot be found closer to the subject property.

So why is this information here and why would you want a realtor to perform a CMA on your proposed residence project? Because you are going to take the CMA the realtor creates and copy it and give it to the Appraiser. Realtors have to report real, factual data. They also can go out of their way, if they happen to be a friend of yours, to seek out those unique upscale houses that have sold near yours that are worth more than less distinctive residences. You are trying to build a case that will help you get your loan and this CMA is the first cornerstone on which you will build your case. Tell your realtor what you would like to see the CMA come in at. Do this with the knowledge that your bank is not going to make you a loan for your house unless the appraisal comes in higher than your loan amount (see below). Do the math (see below) and make sure your realtor looks for those homes that reflect the numbers you are seeking, with size and features similar to your new home design. This is perfectly legitimate. You are like a country lawyer making a case that your nice, architect-designed home will be worth a lot. You are gathering data to support this claim. People financing new homes have to do some homework. Realtors and appraisers are typically licensed professionals and have to honestly report the facts. The point is, steer them toward the facts that help your case, just as a defense attorney presents those facts to the jury that help establish his client’s innocence. You are having a World-class architect design your house so have your realtor look for the nicest homes in the area rather than budget economy houses for your comparables.

2. APPRAISAL:

When financing new homes, the bank or other lending entity normally will insist on providing an appraiser they know and trust that will give them a fair market value of your proposed residential project. You, however, are paying for this, so you have the right to ask who it is and how to contact them, because you want them to be aware of certain features you have proposed for your project that can influence their valuation upward. Yes, you want the appraisal to be high. This is because bankers want to see an appraised value of your proposed house + land = 20% to 25% minimum more than what sum you are borrowing. This is because if the lender has to foreclose on you for not making payments on your debt to them, they can sell your residence for hopefully at least your remaining loan amount. Bankers do not like being in the real estate business, so they typically sell distressed properties for much less than they are worth under normal market conditions, so having that 25%+/- edge makes them feel comfortable taking a credit risk with you.

Therefore, when financing new homes, get hold of the bank’s selected appraiser and give them a copy of the CMA you had a realtor perform for you. The appraiser doesn’t have to use it, but it will be good information and chances are, they will look at it and consider if it makes sense and possibly use some of the comparables suggested. That is good, because you want your proposed house to appraise as high as possible. Why? Well, would you like to get the loan? The higher the appraised value compared to your loan amount, called the loan to value ratio (LTV), wants to be at least about 80% to 75%.

This figure is your loan amount divided by the appraised value (also called the purchase price/value). If your appraisal is twice as much as your loan amount, this figure will be 50%. This is better, as far as the bank is concerned, because when the bank is financing new homes, this means your project is worth twice as much as they are loaning you, so if you don’t pay them for the loan, they can not only foreclose and sell your project, they could actually make more money on it, faster than they would have on the original note.

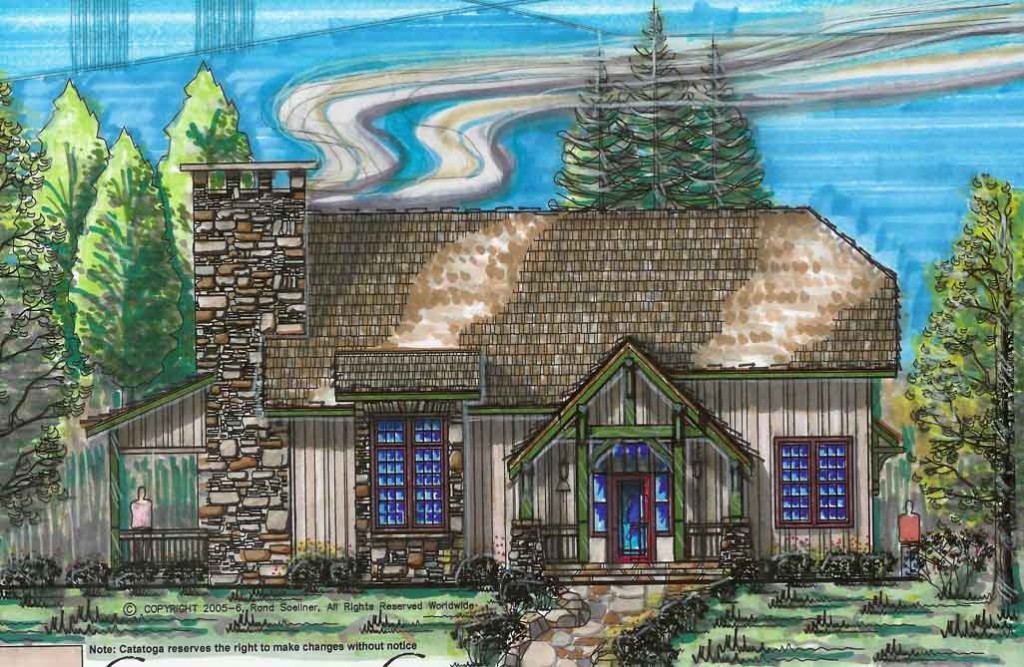

So: when you are financing new homes, do what you can to provide useful, factual information to the appraiser that your project (home + land) is worth as much as possible. Make a list of all the unique upgrades in your project, and if Rand Soellner is designing it, that you are having one of the leading custom home architects designing your project, which ought to make it worth more.

3. LOAN AMOUNT:

This is the amount of money you want to borrow from your bank (or other lending institution). You should make sure that this amount will cover your estimated project costs that you need to finance + a healthy contingency. How much of a contingency? Many people go with 5%. In my opinion, this is not enough. Try more like 20%, or even higher. My experience is that unexpected things can happen during construction, particularly on a custom house. By unexpected, insert <more costly>. Some architects I know have even said, have twice as much or even more than you think things will cost. This varies considerably. Only you know your tolerance for the consequences of what will happen if you don’t have enough money to pay for the costs of your project. Will it bankrupt you? If your answer is “yes,” then do not do it. If your answer is: “No, but I would have to get some more money from another source that I would prefer not to raid, but can, if I absolutely have to,” then, you may wish to consider proceeding. When financing new homes, my experience is that you will end up raiding those other sources by the time you are done. Why? Because of the choices you make. There is no one to blame but yourself and your taste for nice things. When your builder or architect ask you about your choices for flooring for instance, and you choose 11″ wide historic heart pine at a cost of $14/sf as opposed to 2-1/4″ new oak prefinished at $1.99/sf, that is your doing. So, be careful of your choices, as it will impact the funds you need to complete your house. When financing new homes, you also will have soft costs, like the fees of your Architect, your loan closing costs, furnishings and other extras you will want for your residence and all of these can add up to a sizeable amount. If you do not want to pay your own cash for these, then you may need to include them into your financing. But some of you will likely have to front these to get your project moving. Be careful of the total amount you are borrowing, not only regarding your income ability to pay your monthly debt service, but regarding the Loan to Value Ratio discussed above in the Appraisal section. You will probably not be able to obtain financing for more money than 75% +/- of the appraised value of your home + land. So, when financing new homes, do the math on this before proceeding.

This is the amount of money you want to borrow from your bank (or other lending institution). You should make sure that this amount will cover your estimated project costs that you need to finance + a healthy contingency. How much of a contingency? Many people go with 5%. In my opinion, this is not enough. Try more like 20%, or even higher. My experience is that unexpected things can happen during construction, particularly on a custom house. By unexpected, insert <more costly>. Some architects I know have even said, have twice as much or even more than you think things will cost. This varies considerably. Only you know your tolerance for the consequences of what will happen if you don’t have enough money to pay for the costs of your project. Will it bankrupt you? If your answer is “yes,” then do not do it. If your answer is: “No, but I would have to get some more money from another source that I would prefer not to raid, but can, if I absolutely have to,” then, you may wish to consider proceeding. When financing new homes, my experience is that you will end up raiding those other sources by the time you are done. Why? Because of the choices you make. There is no one to blame but yourself and your taste for nice things. When your builder or architect ask you about your choices for flooring for instance, and you choose 11″ wide historic heart pine at a cost of $14/sf as opposed to 2-1/4″ new oak prefinished at $1.99/sf, that is your doing. So, be careful of your choices, as it will impact the funds you need to complete your house. When financing new homes, you also will have soft costs, like the fees of your Architect, your loan closing costs, furnishings and other extras you will want for your residence and all of these can add up to a sizeable amount. If you do not want to pay your own cash for these, then you may need to include them into your financing. But some of you will likely have to front these to get your project moving. Be careful of the total amount you are borrowing, not only regarding your income ability to pay your monthly debt service, but regarding the Loan to Value Ratio discussed above in the Appraisal section. You will probably not be able to obtain financing for more money than 75% +/- of the appraised value of your home + land. So, when financing new homes, do the math on this before proceeding.

4. CONSTRUCTION COST:

This is the amount that your project will cost to build. There is only one person in the World that knows how much this will be: your builder. He’s the guy (or gal) that is laying their economic life on the line, declaring that if you pay them a certain amount, they will provide for you, your requested home on your land. That is a gutsy person. I’ve heard a lot of bad things about contractors in my life, but let me tell you, I would never want to be in their shoes! They deal with about 50+ subcontractors on every project and if they have to fire one, who knows if they will be able to replace them for the same amount as the one they dismissed? Very chancy. And building material prices change all the time, based on whether or not emerging countries like China are absorbing most of the World’s steel production because of their growth spurt. Yet your builder stands tall, saying that they will do this thing for you, for a certain amount. Amazing. Many have clauses in their agreement to help them cover certain unexpected things, which of course means that you will end up paying for some of these. You are not buying a loaf of bread for $1.29 from a supermarket. You are having a one of a kind custom home built for you for the first time on your unique land and there are unknowns. Having a detailed, comprehensive set of architectural documents is one of your best hedges against the unknowns, so that your builder understands what he/she is getting into. The more defined that architect’s drawings and specifications are, the better prepared your builder is and the fewer surprises they will have, which means fewer surprises (usually not a good thing in construction) for you. When financing new homes, your Loan Amount needs to be More than your Construction Cost, to cover other aspects of your project and to have the contingency mentioned above, should the Construction Cost exceed the builder’s estimate/original proposal. Your Architect can assist you with determining these for your project. Prior to signing a contract, I would not advise in involving the builder in determining budgetary potential additional amounts to cover potential future overruns. Not good psychology.

Bottom Line : Financing New Homes:

Okay, so what do you do with all of this information regarding financing new houses? Get a friendly realtor to prepare your CMA that reflects that your home + land will be worth at least 1.25+ multiplied by the amount of your Loan Amount. Give this information to the bank’s appraiser. Hopefully they will regard it as a source of good information and your appraisal will take this into account. Obtain a loan amount to not only cover your Construction Cost, but that will handle your additional features and other cost increases you are likely to experience.

The fact that the process above has worked well for the author is no guarantee that it will work for you and your specific circumstances. Always obtain the services of a professional financial advisor, such as a certified public accountant to assist you in your financial decisions.

This information provided by HOME ARCHITECT ® to assist Clients with financing issues for their projects: Please contact the firm at: 828-269-9046 rand@homearchitects.com www.HomeArchitects.com

Resources and links:

home architects

For federal financing assistance: http://www.whitehouse.gov/

then type in Home Financing Assistance.

1 Comment

uberVU - social comments

2:06 pm - February 28, 2010Social comments and analytics for this post…

This post was mentioned on Twitter by CustomHomeArc: Custom Home Architects tips: Useful advice about getting appraisal: https://www.homearchitects.com/financing-new-homes…